28+ Existing mortgage calculator

Bi-Weekly Payment Calculator For an Existing. Calculate loan payment payoff time balloon interest rate even negative amortizations.

Printable Mortgage Calculator In Microsoft Excel Mortgage Loan Calculator Mortgage Amortization Calculator Refinancing Mortgage

Almost any data field on this form may be calculated.

. A Discount Rate Mortgage is a mortgage where you pay a lower than the normal standard variable rate for a set number of years. The resulting quotient is the DTI ratio. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and.

How to use the mortgage affordability calculator. Refinancing your mortgage means replacing an existing home loan by taking out a new one with your current lender or a different lender. Use our free mortgage calculator to estimate your monthly mortgage payments.

This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. 28 Location Location Location. Banks home equity loan calculator.

There are two options on the calculator below. Then its divided by your gross monthly income. Get home equity loan payment estimates with US.

The act of switching to a new lender to arrange a new mortgage or to renegotiate an existing mortgage. How our mortgage interest rate change calculator works. Your back-end DTI on the other hand must not be higher than 43 percent.

Use Moneys free mortgage calculator to get an estimated monthly mortgage payment based on your loan details. With an interest only mortgage you are not actually paying off any of the loan. A guide to better understanding closing costs is.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Meanwhile demand for those 40 coupons have increased steadily relative to 45 coupons. There may be part of your existing mortgage which is at a variable rate and this will be affected by a rate change.

Back-end DTI ratio is estimated by adding mortgage-related debts and all monthly debt payments. The term commercial is used to distinguish it from an investment bank a type of financial services entity which instead of lending money directly to a business helps businesses raise money from other firms in the form of bonds debt or share capital equityThe primary operations of commercial banks include. Use our mortgage repayment calculator to estimate your monthly repayments or calculate how much you can borrow.

Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. 1 Our quick and easy mortgage calculator also displays the amount of cashback 3 you could get when you drawdown your mortgage. Account for interest rates and break down payments in an easy to use amortization schedule.

Our Canadian Mortgage Calculator allows you to calculate your monthly mortgage payments and cash needed for the purchase of real estate using current lender rates. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. Todays Mortgage Rates Mortgage Calculator.

For conventional loans your front-end DTI should not exceed 28 percent. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income on your monthly mortgage payment. Existing-Home Sales Decreased to 481 million SAAR in July Calculated Risk Blog.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. The loan is secured on the borrowers property through a process.

The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment. The third tab shows current Boydton mortgage rates to help you estimate payments and find a local lender. A mortgage in itself is not a debt it is the lenders security for a debt.

You will get a comparison table that compares your original mortgage with the early payoff. To use our mortgage affordability calculator simply enter your and your partners income or your co-applicants income as well as your living costs and debt. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then.

With a capital and interest option you pay off the loan as well as the interest on it. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. At the end of the mortgage term the original loan will still need to be paid back.

A commercial bank is what is commonly referred to as simply a bank. The 2836 rule may help you decide how much to spend on a home. 28 PM NEW Stucco and Vinyl.

A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. 40 coupons are so much more sought after that a mortgage rate of 5125 earns a mortgage lender MORE money.

The mortgage should be fully paid off by the end of the full mortgage term. So if your lender had a 5 percent standard variable rate and this mortgage gave you a 2 percent discount you would pay 3 percent. However if your lenders standard variable rate rises so will the percent you have to.

The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

Check terms and rates for a home equity line of credit today. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates get cash out at closing and change your loan term to 5 10 15 or 20 years.

Brets mortgageloan amortization schedule calculator. Use the mortgage affordability calculator above to figure out how much you can afford to borrow based on your current situation. The first tab offers an advanced closing cost calculator with detailed and precise calculations while the second tab offers a simplified closing cost calculator which shows a broader range of estimates.

If this is the case we will recalculate the monthly payment on any parts of the mortgage being charged interest at a variable rate and add these to the monthly payments. The formula to calculate this would be x a 28 100 where a is your monthly.

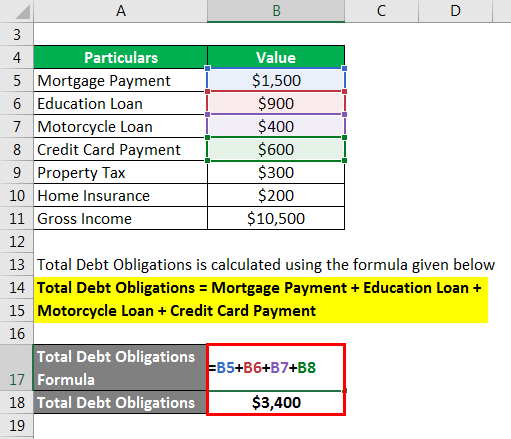

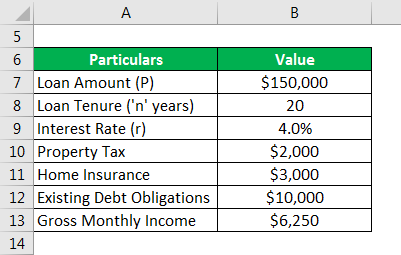

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template

Mortgage Amortization Calculator Amortization Schedule Mortgage Amortization Calculator Loan Calculator

Mortgage Interest Rates Just Went Up Should I Wait To Buy Mortgage Interest Rates Mortgage Amortization Calculator Mortgage Interest

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

Pin On Naca Success Stories

Total Debt Service Ratio Explanation And Examples With Excel Template

Infographics Keeping Current Matters Mortgage Interest Rates Mortgage Rates Mortgage

Total Debt Service Ratio Explanation And Examples With Excel Template

Monthly Payment Schedule Template Lovely 9 Home Loan Spreadsheet Amortization Schedule Schedule Templates Employee Handbook Template

Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Loan Originator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

Mortgage Calculator And Amortization Table With Extra Payments Additional Principal Excel Te Pay Off Mortgage Early Mortgage Loan Calculator Mortgage Loans

Fha Home Loan Calculator Easily Estimate The Monthly Fha Mortgage Payment With Taxes Mortgage Loan Calculator Fha Mortgage Mortgage Amortization Calculator